The insurance sector has traditionally lagged in adopting transformative processes, often relying on outdated methods. However, genAI in health insurance is revolutionizing the industry by enabling innovative solutions and reshaping conventional practices. GenAI, a subset of Artificial Intelligence, is designed to create text, images, audio, and other data types. Leveraging advanced deep learning models, it generates new, contextually relevant content based on existing data.

The global market for AI in insurance is poised for exponential growth. It is projected to rise from USD 8.13 billion in 2024 to a staggering USD 141.44 billion by 2034. This represents a robust CAGR of 33.06% over the decade. Such rapid expansion underscores the transformative potential of technologies like GenAI in reshaping insurance.

However, the adoption of genAI in health insurance comes with responsibilities. Insurers must prioritize compliance with regulations, ethical practices, and robust privacy measures to ensure trust and transparency. By harnessing this advanced technology responsibly, the health insurance industry is poised to evolve into a more innovative and customer-focused domain.

Key Takeaways:

- GenAI is revolutionizing the health insurance sector by enabling advanced automation, personalized customer experiences, and innovative product development.

- The global market for AI in insurance is projected to grow significantly, driven by the adoption of advanced technologies and increasing demand for efficiency.

- GenAI empowers insurers to improve risk assessment, optimize operational costs, and enhance customer satisfaction, ensuring competitive advantage in a rapidly evolving market.

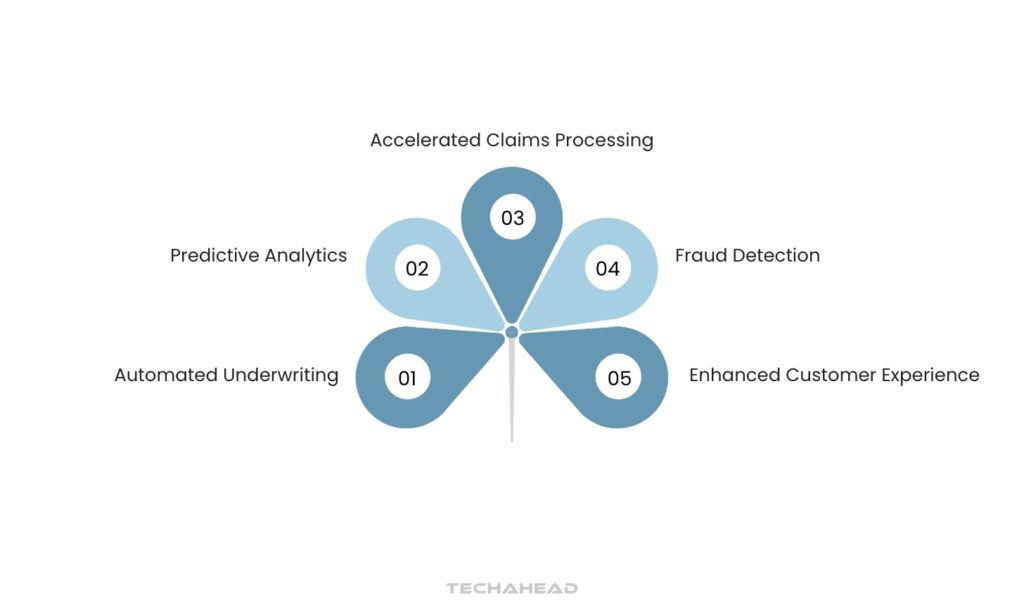

Common Use Cases of GenAI in Health Insurance

The integration of GenAI in healthcare insurance is revolutionizing the industry with innovative applications. Here are some prominent use cases:

Automated Underwriting

GenAI-powered underwriting eliminates manual effort by leveraging advanced predictive models to assess risk more accurately and efficiently. These models analyze diverse variables such as age, health history, and occupation to determine risk profiles comprehensively. GenAI in health insurance underwriting accelerates decision-making, ensuring faster processing for straightforward cases while reducing human errors and bias. This is particularly advantageous for complex insurance products requiring detailed evaluations.

Enhanced Customer Experience

GenAI enables personalized communication by analyzing customer data and market trends to tailor interactions across touchpoints. Virtual assistants and generative adversarial networks (GANs) provide real-time assistance, answering queries and guiding customers through the claims process 24/7. Feedback analysis using GenAI in health insurance identifies improvement areas, strengthening customer satisfaction and loyalty. This technology ensures every interaction adds value, enhancing relationships beyond basic policy coverage.

Accelerated Claims Processing

With GenAI in health insurance claims processing, insurers can automate data extraction from forms, medical records, and receipts, minimizing manual input errors. Simple claims are processed quickly, while complex cases are flagged for expert review. GenAI-driven systems offer real-time tracking, enhancing transparency and ensuring policyholders know their claim status. Additionally, field service management tools powered by GenAI enable precise loss calculation, further streamlining the claims process.

Fraud Detection

GenAI employs GAN systems to monitor claims in real-time, identifying suspicious patterns or deviations to combat fraudulent activities. Advanced algorithms detect inconsistencies in visual evidence, such as manipulated images or documents, ensuring robust fraud detection. Machine Learning integration enables continuous adaptation to emerging fraud tactics, maintaining effectiveness over time. By automating fraud detection, insurers can reduce costs and improve investigation efficiency.

Predictive Analytics

GenAI in health insurance enhances predictive analytics, allowing insurers to identify target demographics and craft tailored marketing campaigns. By analyzing market trends and user preferences, insurers develop innovative, consumer-focused products. Predictive capabilities support effective customer acquisition and retention strategies, ensuring competitive advantage. This approach allows insurers to offer highly personalized services, aligning with evolving consumer needs.

By embedding GenAI in health insurance, insurers can achieve operational excellence, improve customer satisfaction, and create cutting-edge solutions for evolving market demands.

Challenges to Consider GenAI in Health Insurance

While GenAI in health insurance offers transformative benefits, it also presents challenges and ethical concerns that insurers must address:

Data Privacy Concerns

Health insurers handle extensive sensitive data, including medical records and financial information, which demands rigorous security protocols. The use of GenAI in health insurance systems requires advanced safeguards to prevent breaches that could expose critical data and harm trust.

Obtaining informed consent from customers for data collection and usage is vital. Insurers must be transparent about how data is stored, processed, and leveraged. Restricting data collection to legitimate business purposes minimizes risks, while over-collection using automated systems can heighten privacy concerns.

Training Bias in AI Models

The datasets used to train Generative AI in health insurance may contain biases reflecting societal or historical inequalities. This could result in unfair outcomes, such as discriminatory pricing or policy denial.

Mitigating bias involves curating diverse and balanced datasets, which ensure more inclusive outcomes. Regular audits of GenAI systems can identify and rectify biases. Techniques like re-weighting datasets, adversarial training, and de-biasing algorithms are essential to create fairer AI-driven solutions.

Technological Limitations

GenAI systems require high-quality, diverse data to deliver accurate predictions, which health insurers may struggle to access. Additionally, integrating GenAI-powered health insurance systems with legacy infrastructures and scaling them for broader applications poses challenges.

Investing in robust data collection, cleaning, and enrichment processes enhances data quality. Collaborations with data providers and leveraging external data sources can also address gaps. Flexible AI architectures and partnerships with InsurTech firms streamline integration and scalability for these advanced solutions.

Regulatory Compliance

The rapid evolution of GenAI in health insurance outpaces existing regulatory frameworks, leaving insurers struggling to navigate compliance. Without clear guidelines for AI-powered systems, ensuring adherence to evolving regulations becomes complex.

To address this, insurers should collaborate with regulatory authorities to establish best practices and foster compliance. Engaging experts in regulatory compliance ensures alignment with industry standards, reducing potential legal or operational risks.

Advantages of GenAI in Health Insurance

The transformative potential of GenAI in health insurance is immense, revolutionizing various aspects of the industry. Here are its key advantages:

Enhanced Risk Assessment

GenAI-driven systems can process extensive datasets to deliver precise risk assessments, empowering insurers to make more accurate underwriting decisions. This precision minimizes underwriting losses and ensures that policy pricing aligns with real risk levels, fostering financial stability.

Innovative Product Development

By leveraging market data and analyzing consumer preferences, GenAI in health insurance can drive the creation of cutting-edge products. These data-driven insights help insurers design offerings tailored to emerging needs, ensuring competitiveness and market relevance.

Operational Cost Optimization

Automation enabled by GenAI streamlines critical processes, including claims management, underwriting, and customer service, significantly reducing overhead costs. This efficiency enhances profitability while delivering seamless experiences for both insurers and policyholders.

Advanced-Data Analysis and Insights

GenAI can harness neural networks to extract actionable insights from unstructured data, such as social media and news articles. This capability allows insurers to proactively manage risks and quickly adapt to shifts in market conditions, ensuring resilience and strategic advantage.

Improved Customer Retention

Personalized services powered by GenAI in health insurance, combined with efficient claims processing and responsive customer support, enhance policyholder satisfaction. These factors reduce churn and foster long-term loyalty, creating a stable customer base for insurers.

Incorporating GenAI in health insurance enables companies to innovate, optimize operations, and deliver exceptional customer experiences, reshaping the industry’s future.

Conclusion

The adoption of GenAI in health insurance marks a transformative shift in an industry that has long relied on traditional methods. As the global insurance market evolves, the integration of GenAI is becoming essential for insurers aiming to remain competitive and relevant. This technology offers the ability to streamline operations, enhance customer experiences, and create innovative solutions tailored to the changing needs of consumers. From automating underwriting and claims processing to detecting fraud and providing personalized services, GenAI empowers insurers to meet modernized healthcare challenges with efficiency and precision.

This topic is especially relevant for insurers looking to address the growing demand for faster, more accurate services while optimizing costs and maintaining compliance with evolving regulations. GenAI is not just a technological upgrade but a strategic necessity to stay ahead in a rapidly advancing digital landscape. For policyholders, this shift promises better service, improved transparency, and more tailored insurance products. For industry leaders, it offers a pathway to reshaping the future of health insurance by leveraging the full potential of artificial intelligence.

By embracing GenAI responsibly, insurers can build trust, drive innovation, and create a more efficient, customer-centric industry. The time for health insurers to act is now, as the future of the industry depends on it.

FAQs

GenAI, a subset of artificial intelligence, creates contextually relevant content using deep learning models. In health insurance, it automates underwriting, enhances claims processing, detects fraud, and personalized customer experiences.

GenAI improves operational efficiency, enhances customer satisfaction, reduces costs, and enables precise risk assessments. It also supports innovative product development and delivers actionable insights through advanced data analysis.

GenAI automates data extraction and verification in claims processing, reducing errors and speeding up decisions. It flags complex claims for expert review and provides real-time updates, enhancing transparency for policyholders.

Insurers can use diverse datasets, perform regular audits, and implement de-biasing algorithms to ensure fairness in AI-driven decisions. Adopting ethical AI practices further reduces the risks of bias in operations.